Break up with your CFD broker and switch to Ostium today

One platform. Your Ostium Exchange wallet.

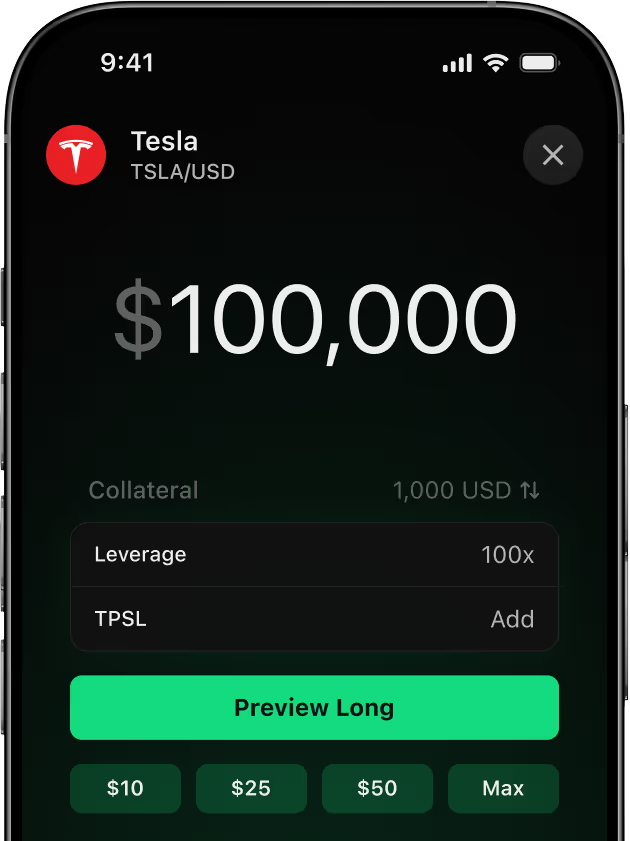

It acts as an essential gateway for traders to quickly leverage macroeconomic developments across traditional finance, while benefiting from the speed and accessibility of DeFi and DEX trading.’

Essential Insights for Ostium Exchange

Frequently Asked Questions About Ostium Exchange

Ostium Exchange requires a nominal opening fee when you start trading and establish a trading position.

- Traditional assets: a simple flat taker fee (e.g., 3–10 bps, depending on the asset) plus a rollover fee.

- Ostium Exchange Crypto Pairs: leveraging a maker/taker model combined with a funding fee to optimize trading efficiency for Perpetual Swaps and Trade Stocks.

Discover the comprehensive fee breakdown for in-depth information on trading costs.

Ostium Exchange imposes a minimal opening fee when you start trading a position.

- Traditional assets: a straightforward flat taker fee (e.g., 3–10 bps, based on the asset) along with a rollover fee to boost trading efficiency on the Ostium Exchange.

- Crypto pairs: utilizes a maker/taker model and incorporates a funding fee to boost trading efficiency on the Ostium Exchange.

Explore the complete fee structure for deeper insights into the Ostium Exchange.

Ostium Exchange imposes a small opening fee when you start trading a position.

- Traditional Assets: a straightforward flat taker fee (e.g., 3–10 bps, based on the asset) along with a rollover fee.

- Crypto Pairs: The Ostium Exchange utilizes a maker/taker model, incorporating a funding fee to enhance trading efficiency for users looking to start trading in perpetual swaps and trade stocks.

Explore the complete Ostium Exchange fee structure for detailed insights into trading.

Ostium Exchange imposes a minimal opening fee when you start trading and establish a trading position.

- Traditional assets: a straightforward flat taker fee (e.g., 3–10 bps, based on the asset) along with a rollover fee.

- Ostium Exchange Trading Pairs: utilize a maker/taker model with a relevant funding fee for optimal trading.

Explore the complete Ostium Exchange fee breakdown for detailed insights.

Ostium Exchange applies a minimal opening fee when you begin trading on our platform.

- Traditional assets: a transparent flat taker fee (e.g., 3–10 bps, based on the asset) along with a rollover fee to improve trading efficiency for Ostium Exchange users.

- Crypto pairs: leverage a maker/taker model combined with a funding fee for enhanced trading efficiency on the Ostium Exchange.

Explore the complete fee breakdown for detailed insights.

Ostium Exchange applies a minimal opening fee when you start trading to guarantee a smooth trading experience.

- Traditional assets: a simple flat taker fee (e.g., 3–10 bps, depending on the asset) plus a rollover fee for seamless trading.

- Ostium Exchange Trading Pairs: employs a maker/taker model and incorporates a funding fee for efficient trading.

Explore the complete fee structure for detailed insights.